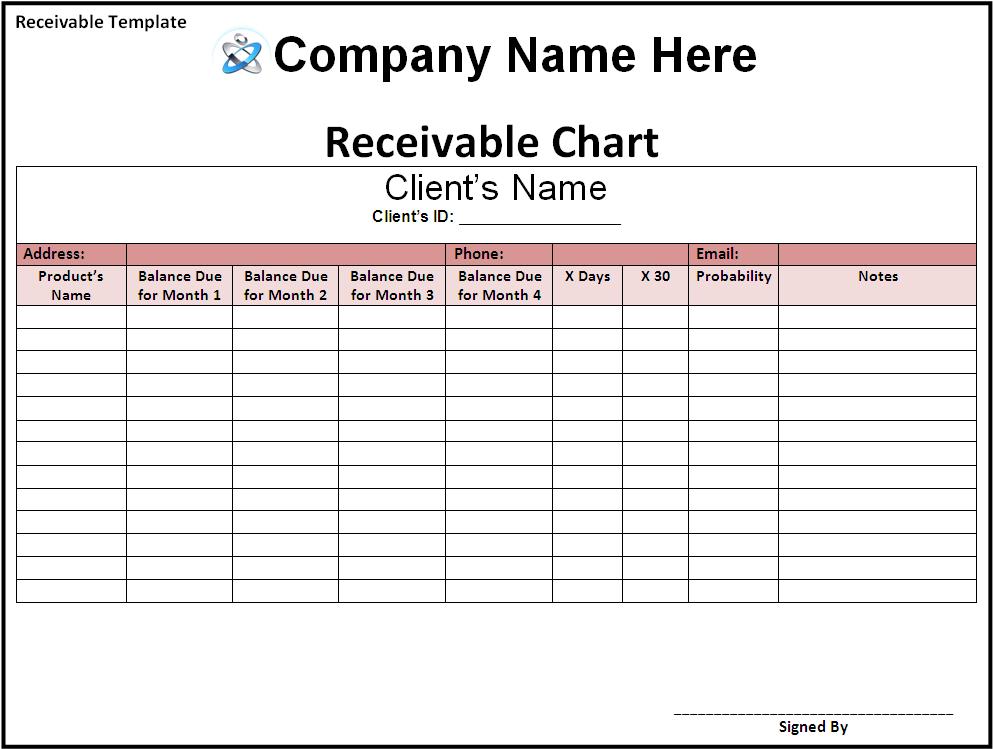

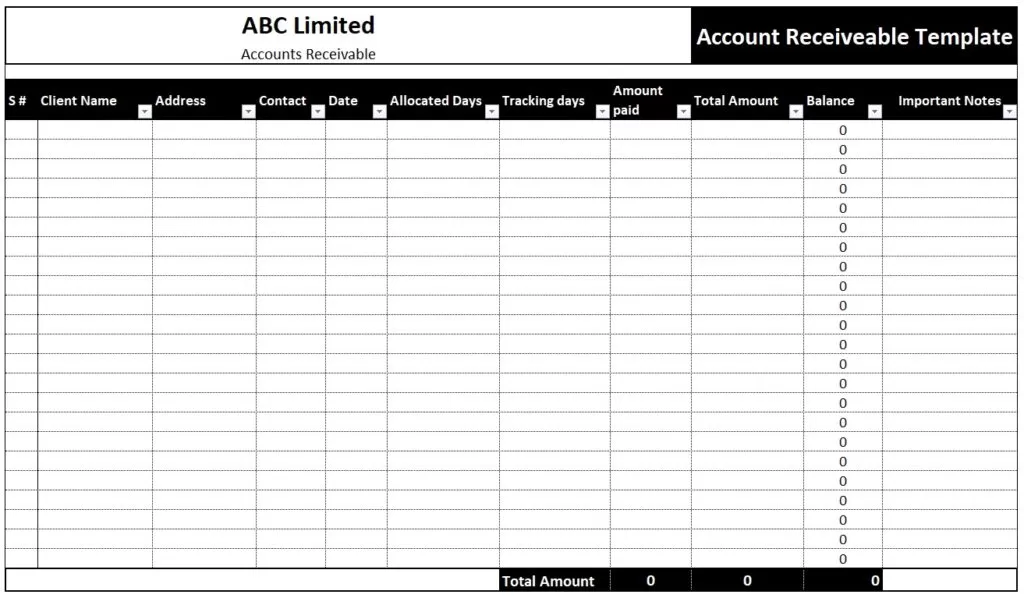

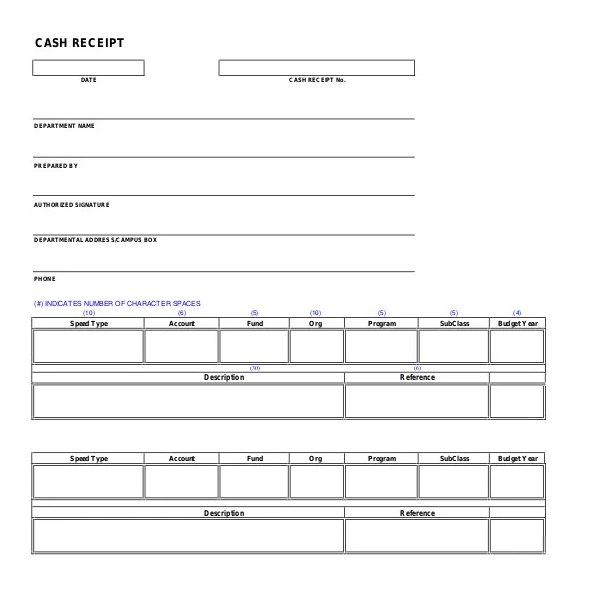

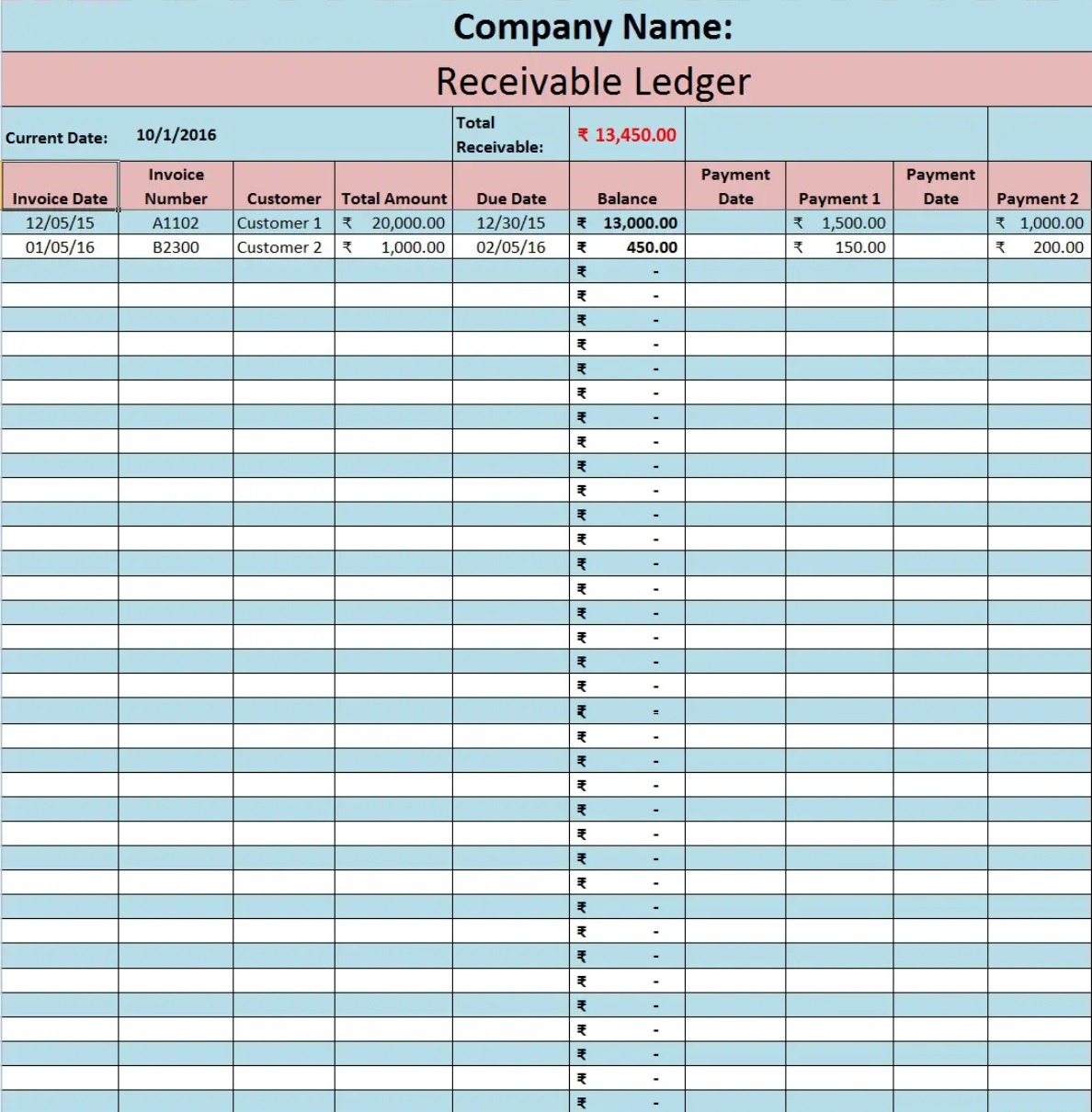

A cash receivable form can be defined as a process which develops by companies, businesses and organizations to professionally ask for cash they want to get from another company, client or corporation. Undoubtedly, whenever a company wishes to manage their accounts or collect all the receivable balance from clients and the management, they’ll fill in a form and submit it for the consideration of such clients who are in some such way bound to pay their balances as a means of cash. In almost all businesses, no matter whether you are an entrepreneur or CEO, every time you may need to pay close attention to the cash account. This is because it is actually the lifeblood of your company, which will decide whether your business is capable of running operating activities or not.

Benefits of Cash Receivable Form:

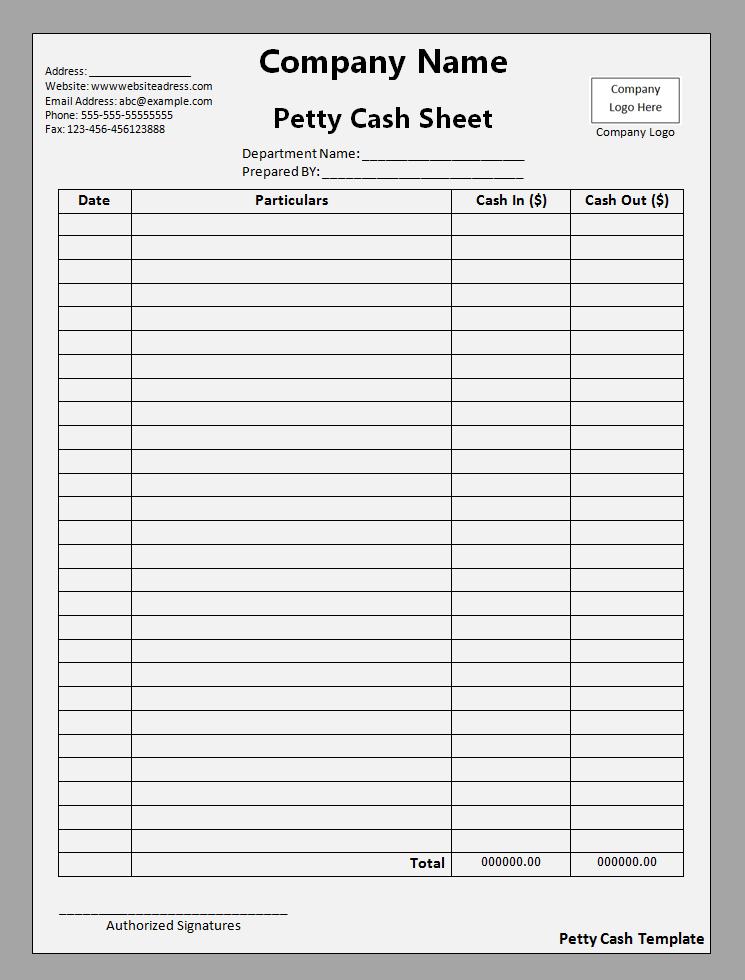

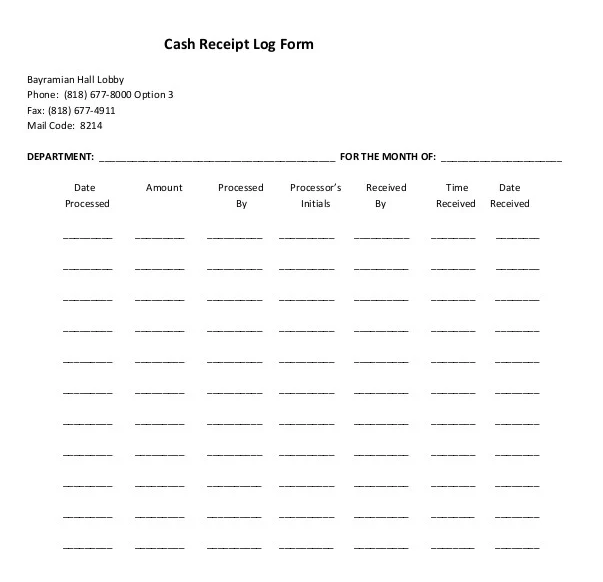

As far as the financial management of a company is concerned, keeping the right amount of currency to meet daily minor cash expenses is the biggest challenge. That is the reason why a cash receivable form serves you like a smart document that typically determines how much amount you should be allowed to keep at the office. However, it has a competitive prominence that covers your short-lived presence in the marketplace. Moreover, this form helps those people who are dealing in cash transactions to maintain the right amount of currency. Here, the most obvious benefit of the cash receivable form is to legally explain a business to pay its petty cash expenses within a specified period of time which usually based on more than thirty days.