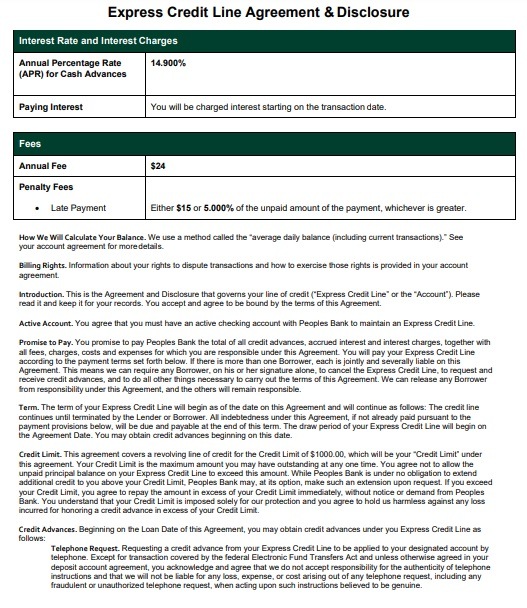

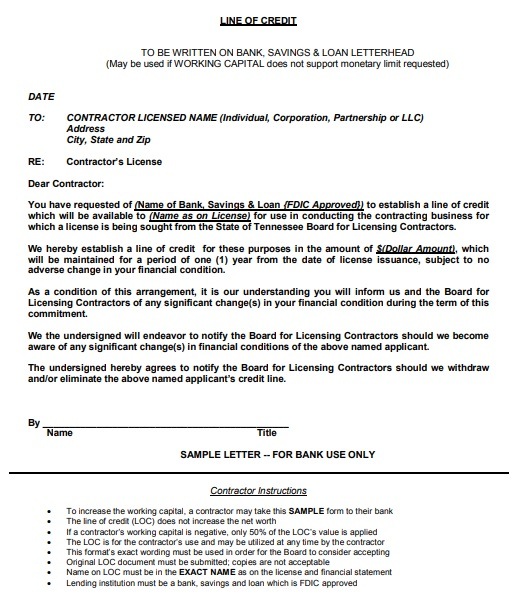

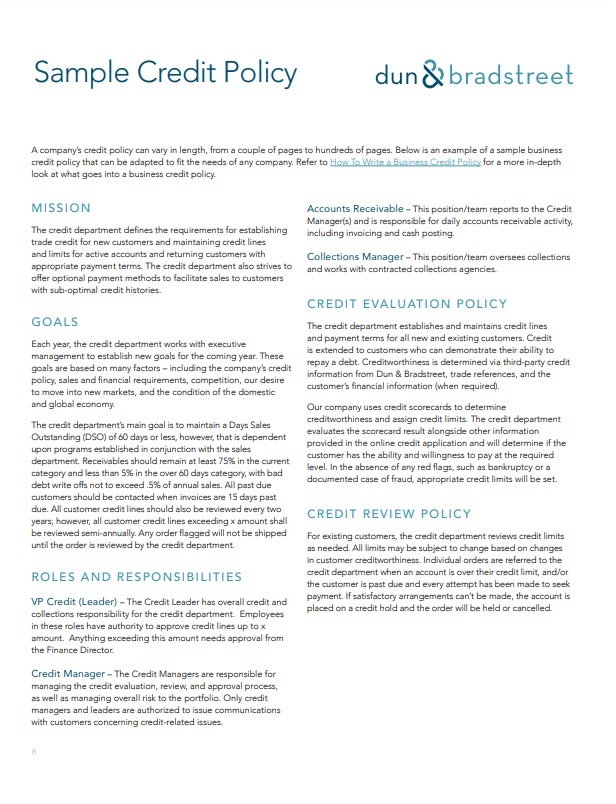

A credit limit notice template is the maximum amount of money that a borrower can charge on a specific credit account or the maximum amount of money a bank allows a borrower to spend on a single card. It is also known as a credit line or line of credit. Usually it is based on various factors that influence a borrower’s ability to repay and is determined by the bank based on your credit score, income and debt-to income. Generally, lenders set the credit limit notice template, which is based on the information in the application of an individual looking for credit. Normally, with careful analysis and establishing proper credit limit will minimize risk exposure.

Importance of Credit limit Notice

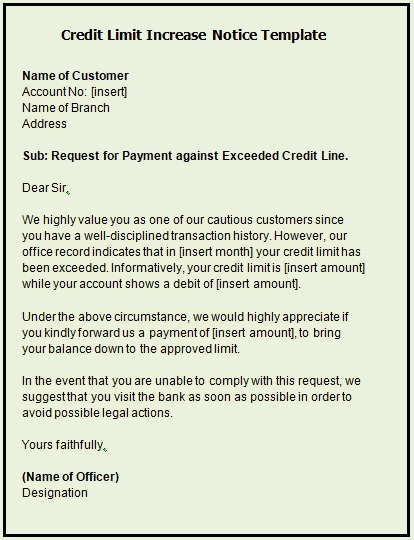

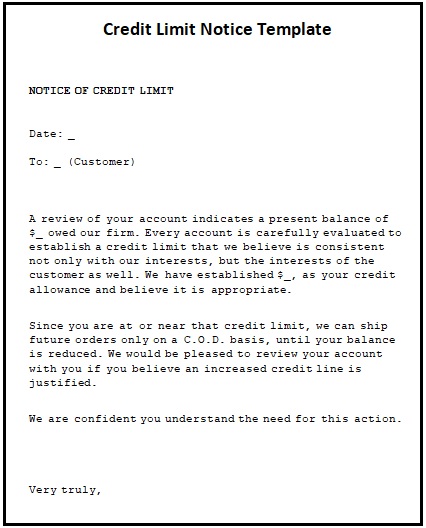

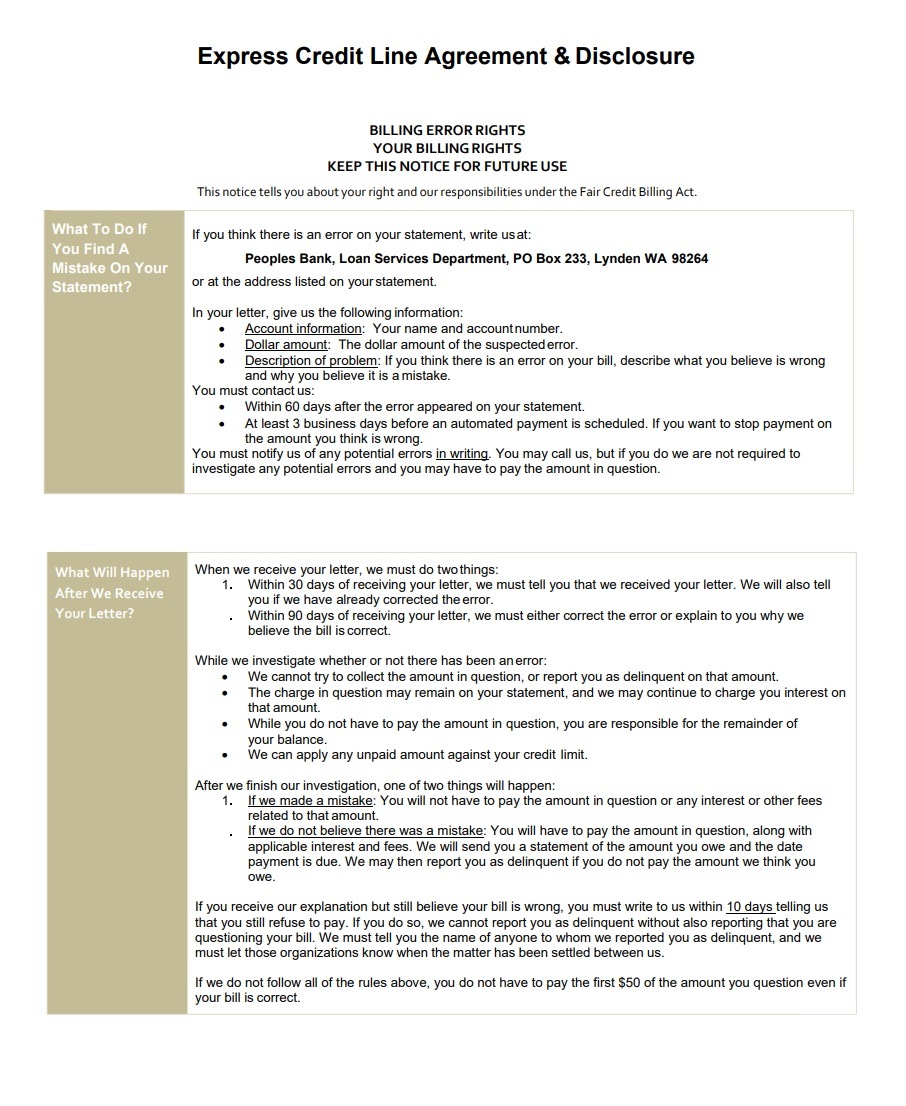

While using a credit card, it often happens that the limit of your credit card may exceed. It will have negative consequences on your budget, and if this happens habitually, the card lender may overcharge or decrease the card limit or may increase the interest rate. The most likely effect that may have is that it will damage your credit reference or credit score. So, it is very important for you to keep yourself updated by knowing the credit card limit in the form of notice. By receiving such a notice you will be able to get to know how much you have already spent or how much more you can.

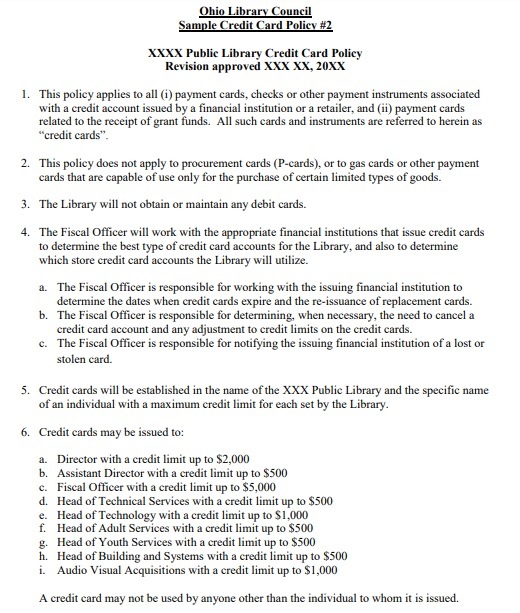

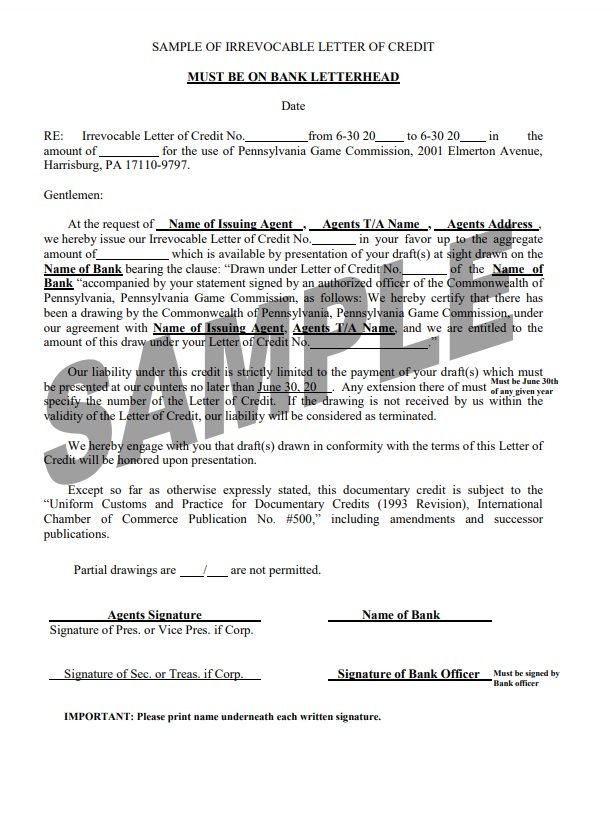

Details of Credit limit Notice Template

Generally, the borrower may spend up to the credit limit notice template, but if he/ she exceed that amount then typically faces fines along with his regular payments. Mostly, lenders retain the right to change the credit limits but in case if borrower pays his/her bills on time every month and does not exceed from their credit limit notice format, then the borrower is probably to increase the credit limit sample. On the other hand, if borrower fails to make repayments on time or lender sees other hints of risks, then lender may prefer to reduce credit limit.

Effects of Lower Credit limit

Credit limit of any client based on the credit score which client has maintained over a period of business life. Naturally, when a financial institution lowers your credit limit means, there is a problem with your credit score. Problems with your credit score bitterly affect your ability to borrow more funds from your present lender or any other lender. Usually late payments of your monthly installments or payments of interest cause such a dip in credit score. This is because the calculation of a credit score is based on how much limit is used and how well it is serviced by the client. Moreover, it also depicts how effectively you are using credit limit and how much percentage of credit limit is used. Sometimes, banks and financial institutions decrease your limit due to usage. Suppose, if you are using 60% of your given credit limit over a period of three months or six months, then the remaining 40% will be unused and fruitless. Therefore, bank consultants may opt to reduce the limit by 25%.