A free invoice template is a professional format which is sent by a seller to a buyer, requesting payment of the transaction. It is prepared when your client owes a sum against goods or services which you have sold. This invoice can be sent either by post or through email, which is now becoming more commonly these days. The purpose of sending invoice is to display the due amount or remaining balance which should be paid by now. It further includes a detailed description of the transaction against which the seller is demanding payment. Characteristically, an invoice reflects a business record of one or all sales transactions to a single buyer or multiple buyers. Professional experts prefer using blank invoice formats to understand various business analytic factors which helps to determine profit and loss as well as tax amount during a specific time frame.

Purpose of Free Invoice

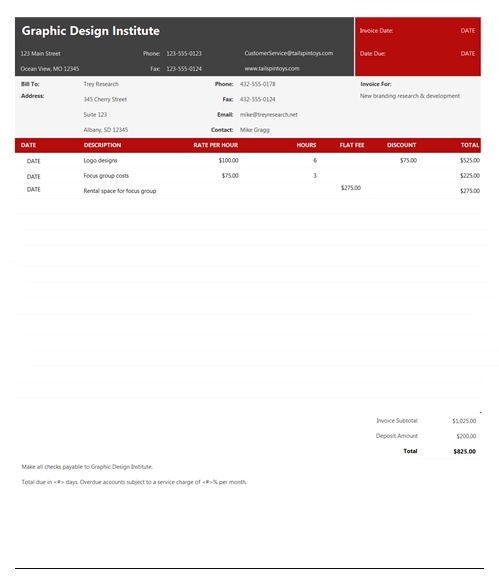

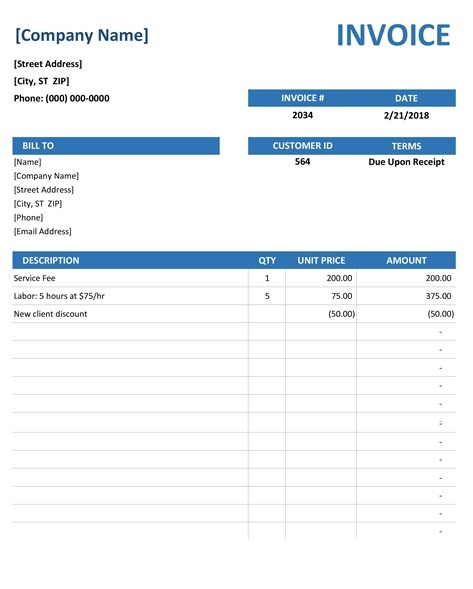

The purpose of sending a business invoice is to release the buyer regarding his/her obligation to pay the mutually agreed amount. Nevertheless, there is no set rules or guidelines for a standard format which can be presented as an invoice, but a professional invoice format needs to have special information on it. The description on invoice should be given in a detail way because a reader always love to find out what this invoice is about. A user simply wish to know all critical points on an invoice as early as possible. The most crucial points included invoice number, due date and total amount to be paid. If it is hard to get the total amount and due date in any invoice, then you need to revise it.

Why a free Invoice is Used?

A free invoice is equipped with multiple functions as far as business transactions are concerned. However, the following are main business spheres where an invoice can be used proudly. These are given below;

1- Legal Support: There is no doubt that an invoice, when signed by all parties, become a legally binding agreement which secured the interest of all parties. It documents the transaction details among parties, terms and conditions regarding goods or inventory as well as payment. It provides a legal roof for all parties, especially while dealing in any dispute.

2- Secure Arrangement: An invoice is a highly helpful tool because both the buyer and the seller looks for secure arrangements. Business life outside local markets is very complicated and full of threats. Therefore, an invoice make sure all arrangements are secure and prompt, especially for long-standing business arrangements.

3- Business Documentation: Another crucial use of an invoice is being part of business documentation, which can further uses to prepare various financial statements. The data incorporated on an invoice is very valuable for stakeholders and investors to calculate expected sales volume as well as profitability.

Content of a free Invoice

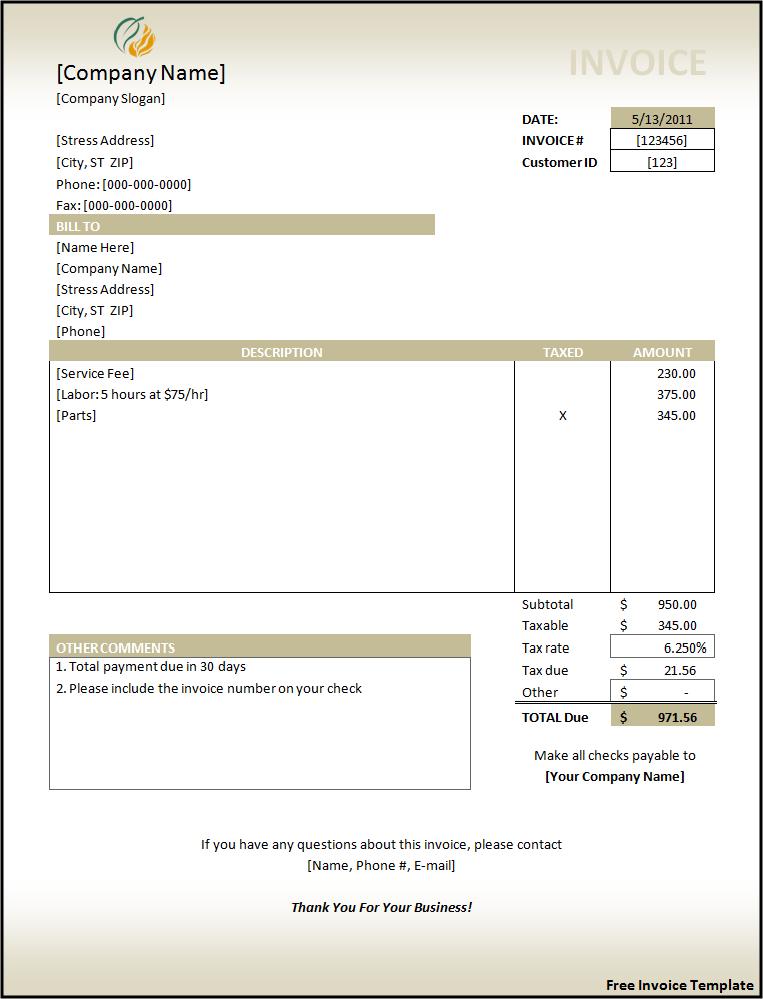

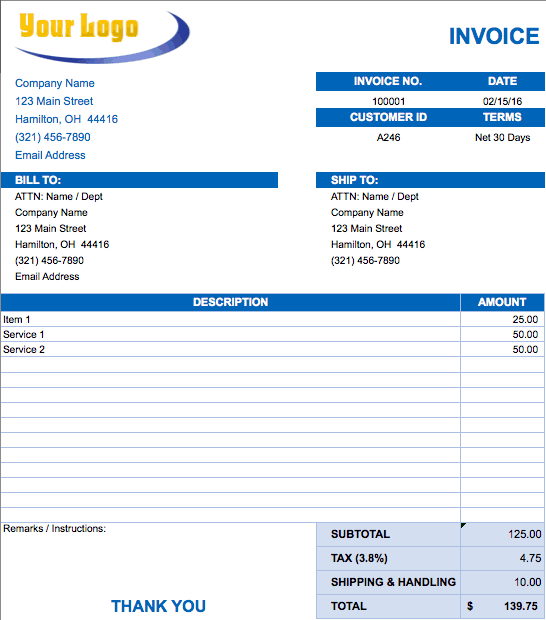

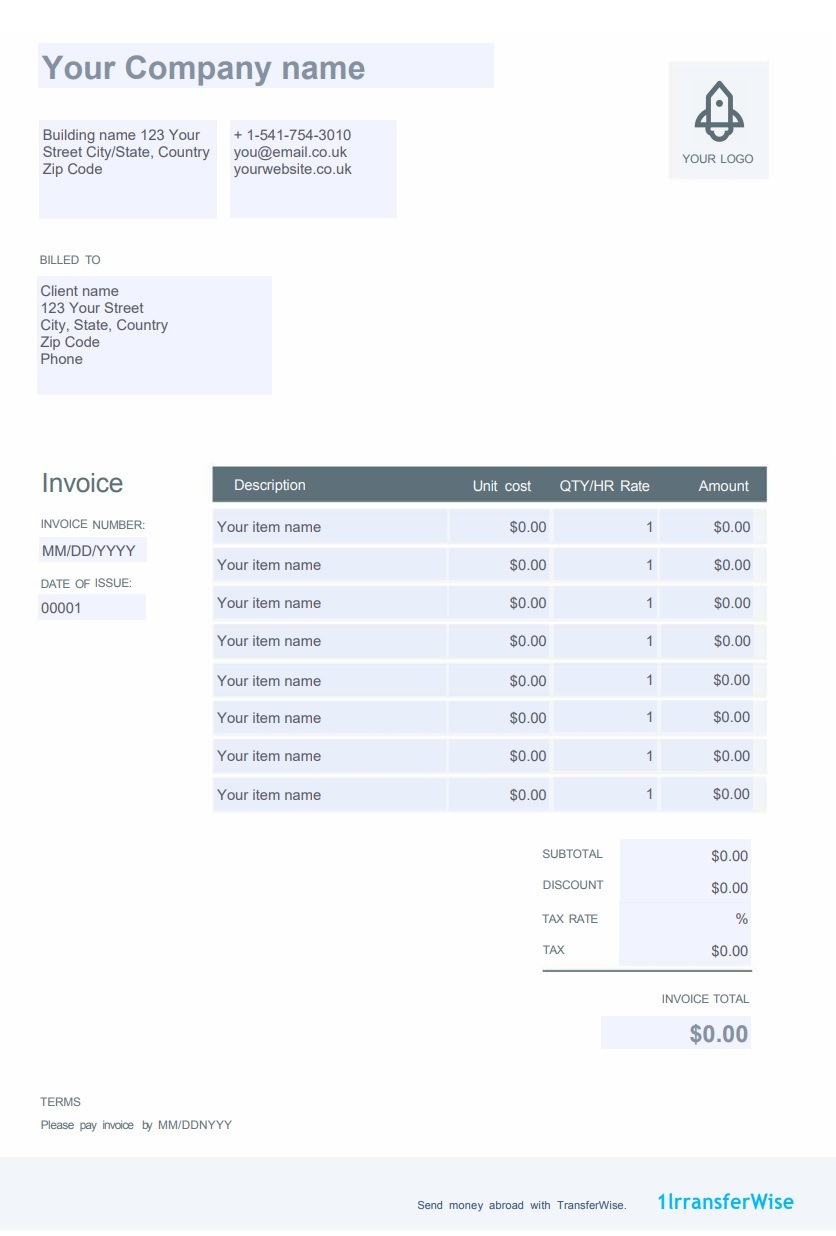

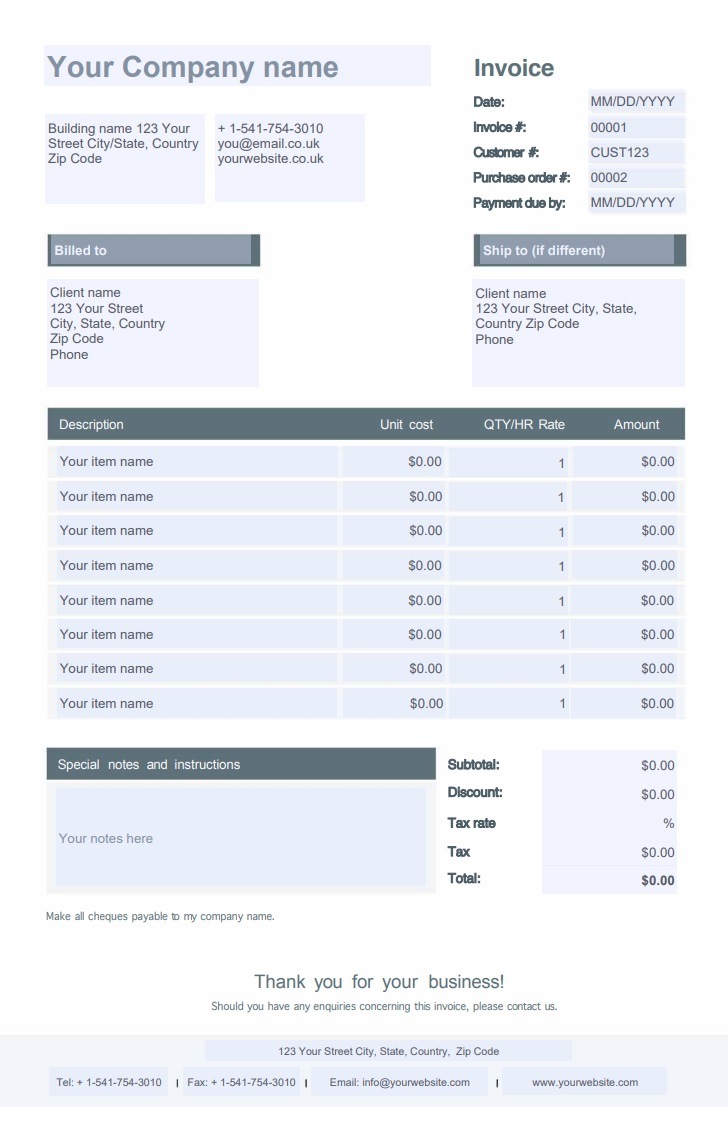

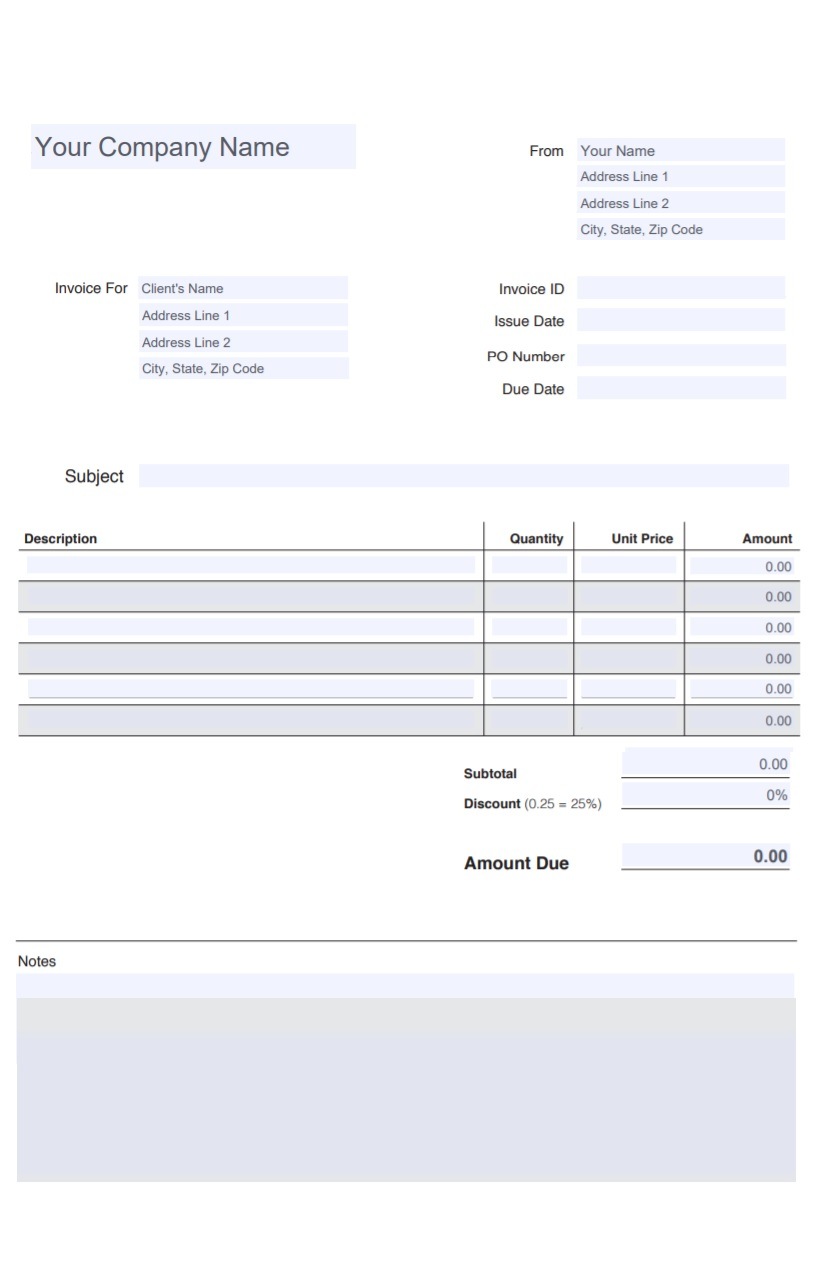

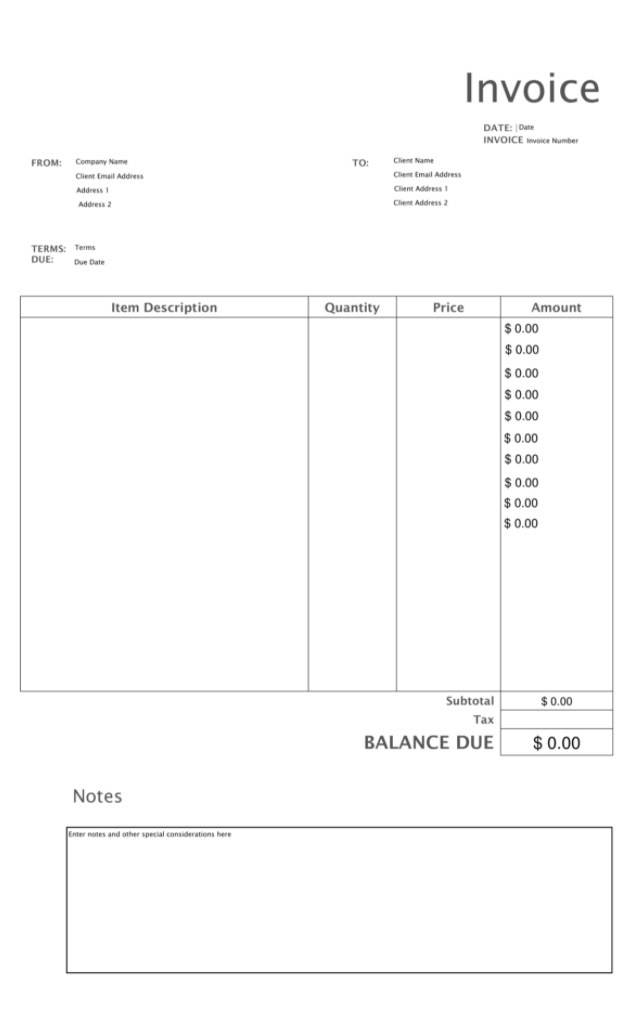

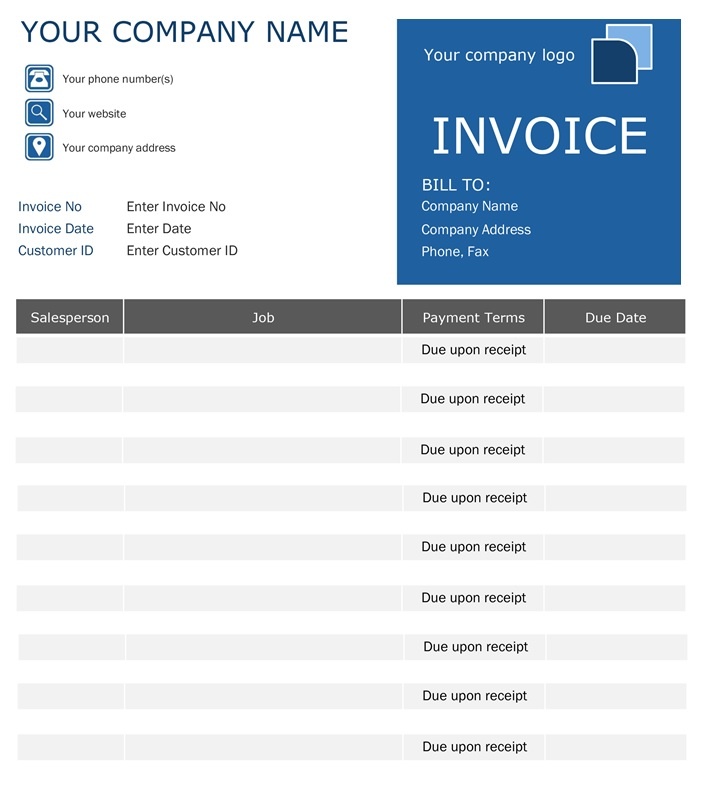

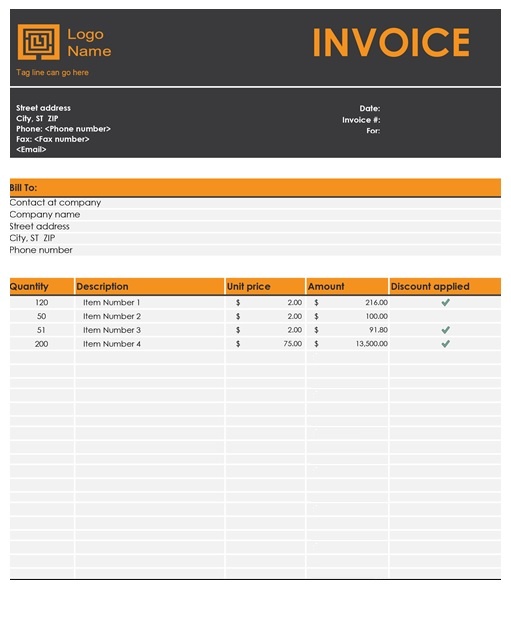

A free invoice can be prepared by an expert as it holds legal value. However, a simple user can also prepare it by understanding some crucial points. To provide a clear picture of an invoice, underneath are some mandatory points which should be included in your business invoice. These are given below;

Business Name

Give your business name and business logo in simple way.

Business Address

Make sure to give the proper address of your business where any correspondence can be mailed. You don’t need to give address separately if your business logo incorporates your business address.

Telephone Number

A business invoice should include a business phone number that will help the customer in contacting you for assistance with any queries.

Purchase Order Number

Make sure to state purchase order number in clear manners.

Invoice Number

Invoice number is used as a control element on many accounting correspondences. Don’t make a mistake to repeat invoice number because payment of an invoice having repeated invoice number will be refused.

Paper Size

Leave sufficient blank space on your business invoice to add additional information if needed because accounts payable department may use to add a date stamp with authorized signatures and account allocation.

Paper Type

If you used to mail your business invoice, then you are suggested to use paper of distinctive color and texture so that the purchaser may find it convenient to get your invoice amongst a pile of other bills to be paid.

Payment Details

Try to make it easier for purchasers to pay you. You should offer them a variety of alternatives and provide them with detailed information about payment. If you require them to pay you via check or postal order, then make sure to give your account name, number and complete address. If they are required to make payment directly to your bank account, then provide your account name, BSB number and account number in your business invoice. Keep your payment methods same while preparing a sales invoice.

Taxation Information

You should provide information about taxation for instance if you are not registered then you will issue an invoice not a tax invoice and you are not eligible to claim GST but if your business is registered then you will issue invoice claiming GST. A tax invoice template is also a handy tool to be considered while preparing your first invoice.