An insurance policy template is a legal document itemizing the terms and conditions of an insurance agreement which is issued by an insurance company to an insured. It is very important for everyone to read and understand insurance policy before accepting it and signing on it. Being a legal agreement, it holds enormous value on both sides. Whereas, it acts as legal evidence of the insurance contract and outlines the exact terms on which the compensation cover has been given. These agreements are designed to meet specific needs and thus have many features that cannot be found in any other agreements. These agreements are generally considered as contracts of adhesion because the insurance company draws up the contract and the insured has no capacity to make changes to the agreement.

Importance of Insurance Policy:

In order to avoid any financial crisis, we all try our best to have some sort of savings for the hour of need. But one of the best ways of saving is insurance. It is considered as a defensive step to make your financial condition stable. As the savings are put aside in a safe place, they will drain at once as any disaster takes place. In such situations, insurance is the only means to protect your finances. Other than this, an insurance policy template will help you to get all the required information at once.

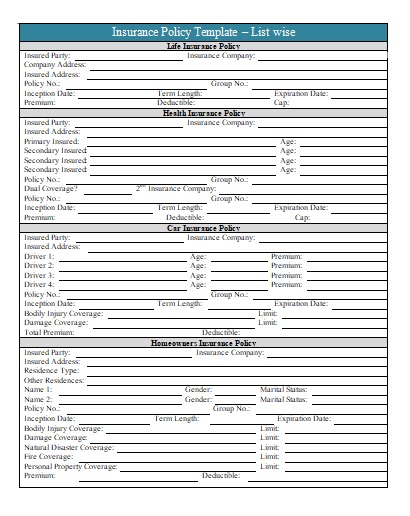

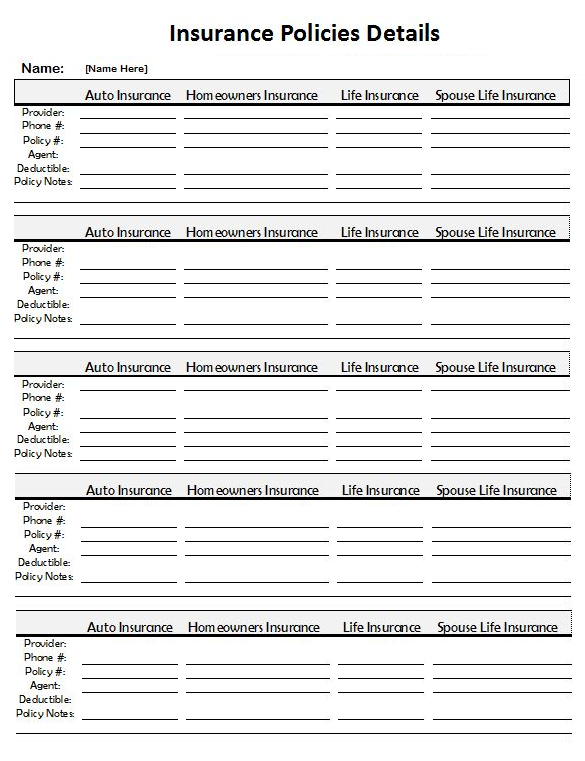

Details of Insurance Policy Template:

Basically, the sample insurance policy format is usually an incorporated agreement that includes all forms allied with the agreement between an insurer and insured. The insurance policy contracts were commonly written on the basis of every single type of risk and a separate premium was calculated as well as charged for each. This document also defines the coverage, premiums and deductibles. Some major parts of an insurance policy such as declarations, definition, insurance agreement, exclusion, terms, conditions, policy forms and endorsements. Moreover, it also states the associated such as particular risks or peril covered, duration of coverage, amount of premium and the mode of premium payment.