A promissory note template is used to prepare a promissory note which is a written promise between two or more parties to pay an agreed specific amount on a specific date to a specified person or the bearer or on demand. It is a financial instrument that serves as proof of a promise made by one person to pay a certain amount of money to another according to a decided mode of payment. You can say it as a legal agreement which bonds both parties for payment either in installments or upon demand. This document ensures all parties involved in this promise to clear who will make the payment and who will be the recipient of payment. There are some legal terms associated with this document to make it legal. Here I will give definitions of these legal terms before I move forward with describing pitfalls that need to be avoided while writing this document:

Promisor: Promisor is a person who signs the original document and makes a promise that he/she will pay a certain amount of money to the other party within the stated time following the terms of payments described in the promissory note.

Promisee: He/she is the person to whom the promise is being made. He/she will receive money by promisor on a specific date.

Obligor: This is another term used for a promisee who is entitled to receive money.

Consideration: Consideration is a legal term which means value obtained in return through a transaction by both involved parties. Consideration must be legal in nature and clearly communicated to both parties.

Pitfalls to Avoid in Promissory Note:

Security of Loan: Basically, a promissory note is an unsecured obligation which means that in case the borrower declares bankruptcy, the loan secured by a promissory note will be paid after making payments to all secured creditors. If you are going to lend a huge amount of money, then you should ask the borrower for some security; a lien or mortgage against real estate. Consulting a lawyer can help you with making your promissory note bulletproof.

Usury: This term refers to the illegally imposed higher rate of return. All parties agree for a promissory note should check the local interest rate and make sure you are not signing a promissory note that will enter you in a usurious contract. Different jurisdictions have different interest rates for individuals than for banks, so confirm the prevailing interest rate and make the promise accordingly.

Late fees: Like interest rate, there may be limits to charging late fees in the case of late payment. Make sure to check your local laws regarding limits on charging late fees.

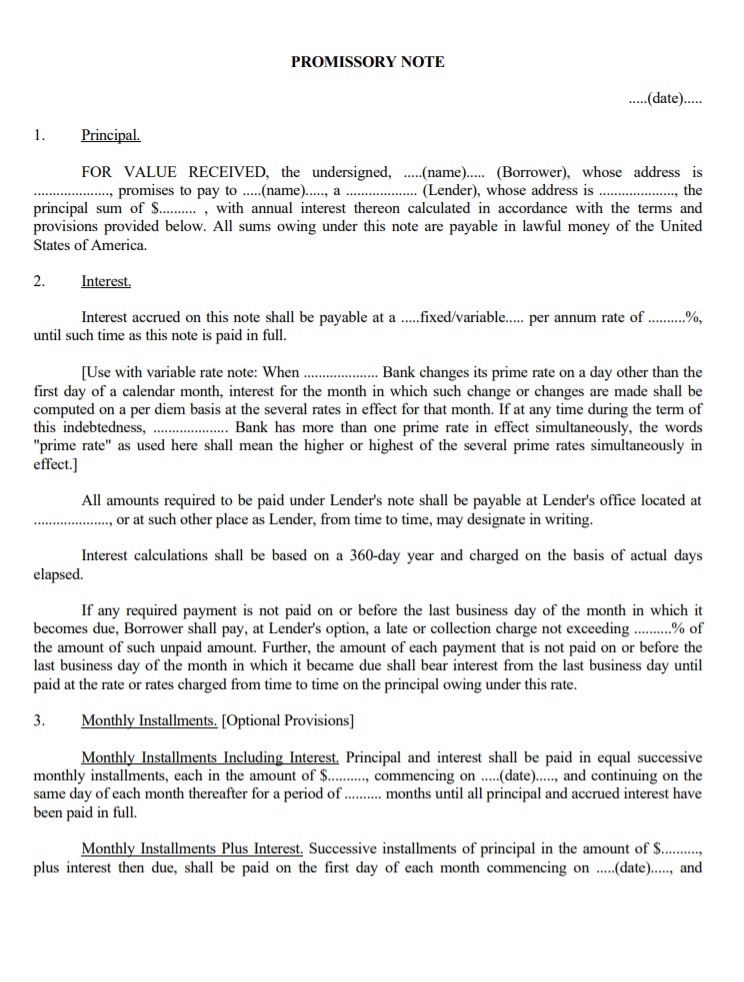

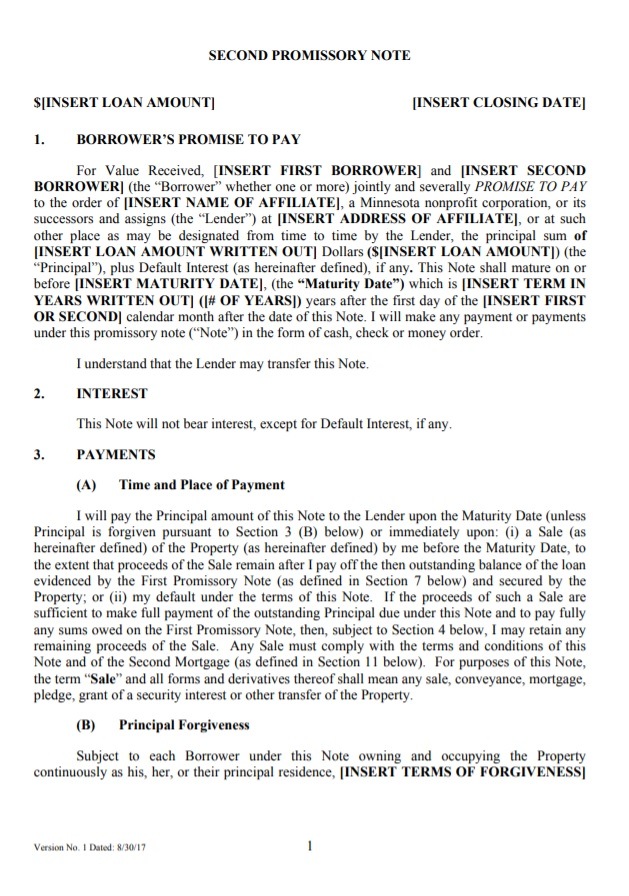

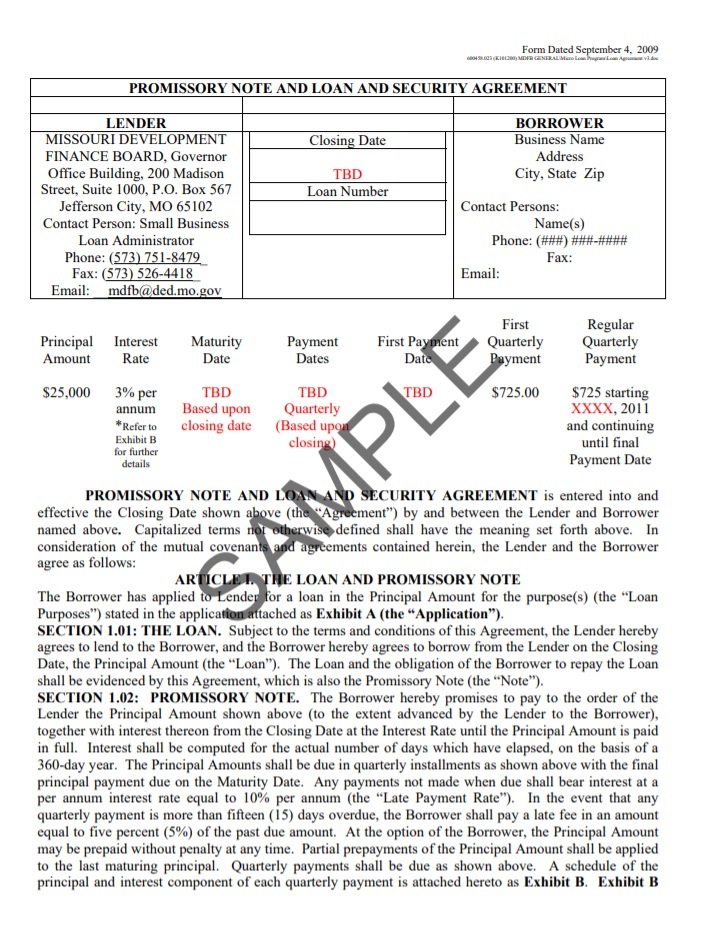

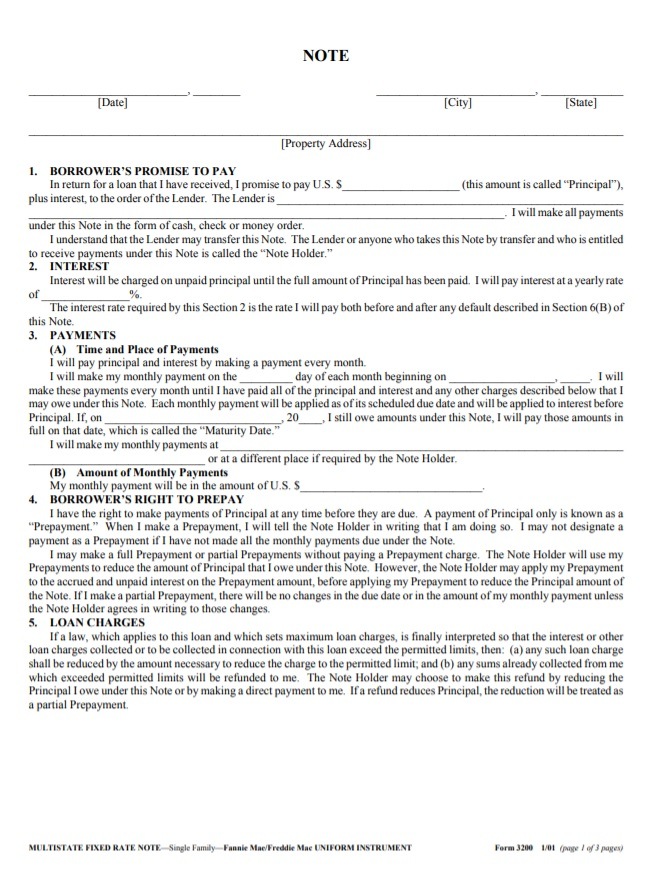

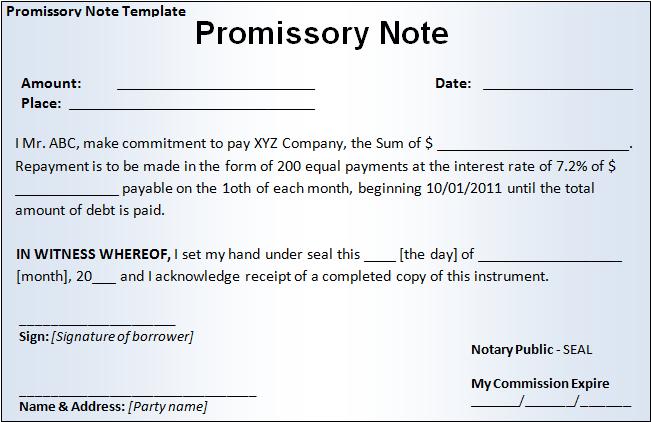

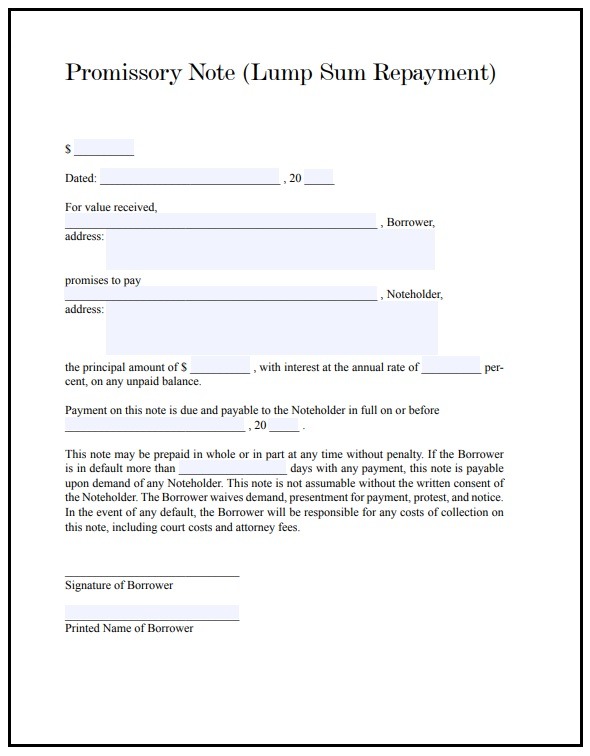

Make sure of legal terms while writing a promissory note and get it signed by all involved parties. A draft promissory note template containing detailed information about this agreement. You can use a promissory note template to have an idea about the format and necessary contents of the promissory note.