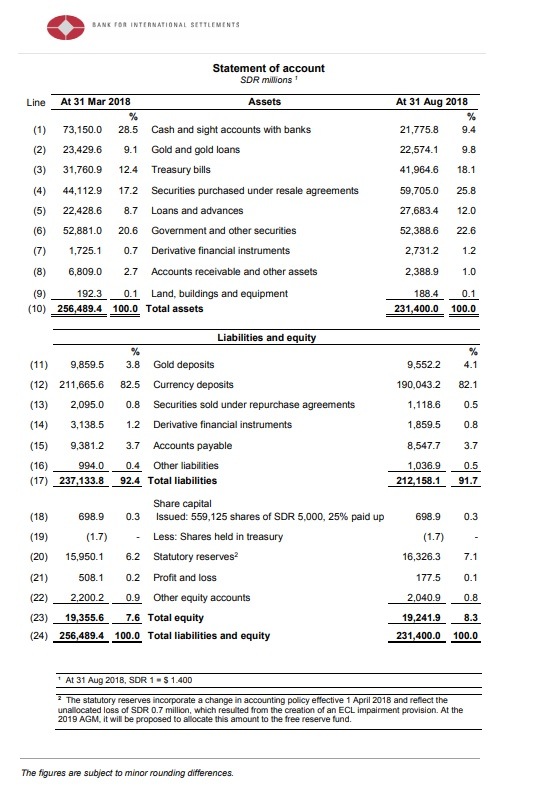

The statement of account template is a formal statement which means, details of specific account either terms of individual or firms. It is also known as statement of customer account or statement of client account. It provides concise details about account activities or transactions within account and with other accounts; either way by transactions or dealings. There are now different software available where, by clicking on account, you will get whole statement. You can also search with transaction, history or amount wise to located and understand details. It is also known as account holder statement in terms of financial institutions or in banking terms.

What is the Definition of Statement of Account?

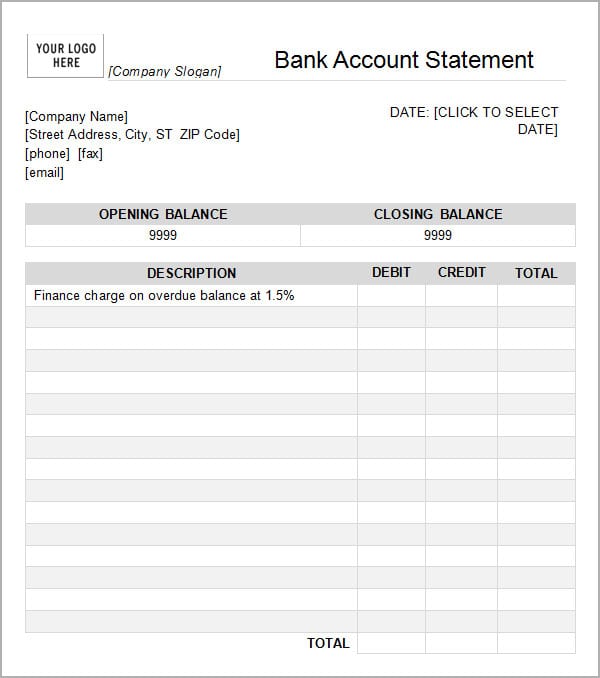

There is no difference between an account statement or statement of account whereas both are same words and can be use in different orders. As the word or title “account” comes out in front of us, the first understanding which pop-up in our mind is as “bank account”, well aside from assumptions let’s have a look on the main definition of account statement. Basically “a statement of account is an official written document which is consistently prepared by financial institute via listing about the content regarding to the milestones of transactions”. It is a most common statement which relevantly known for checks and consolidated financial accession of accounts.

What is the Purpose of this Statement?

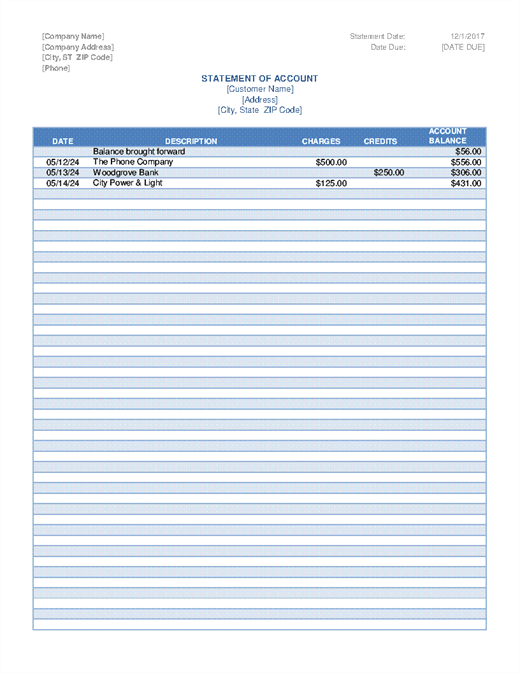

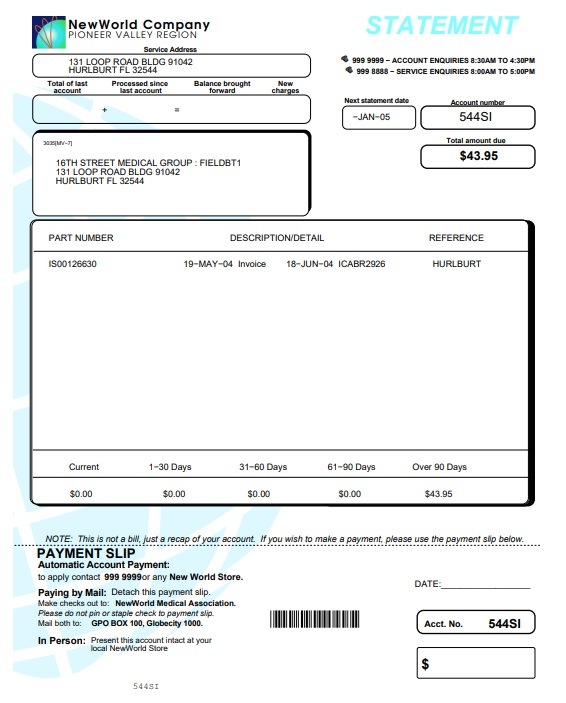

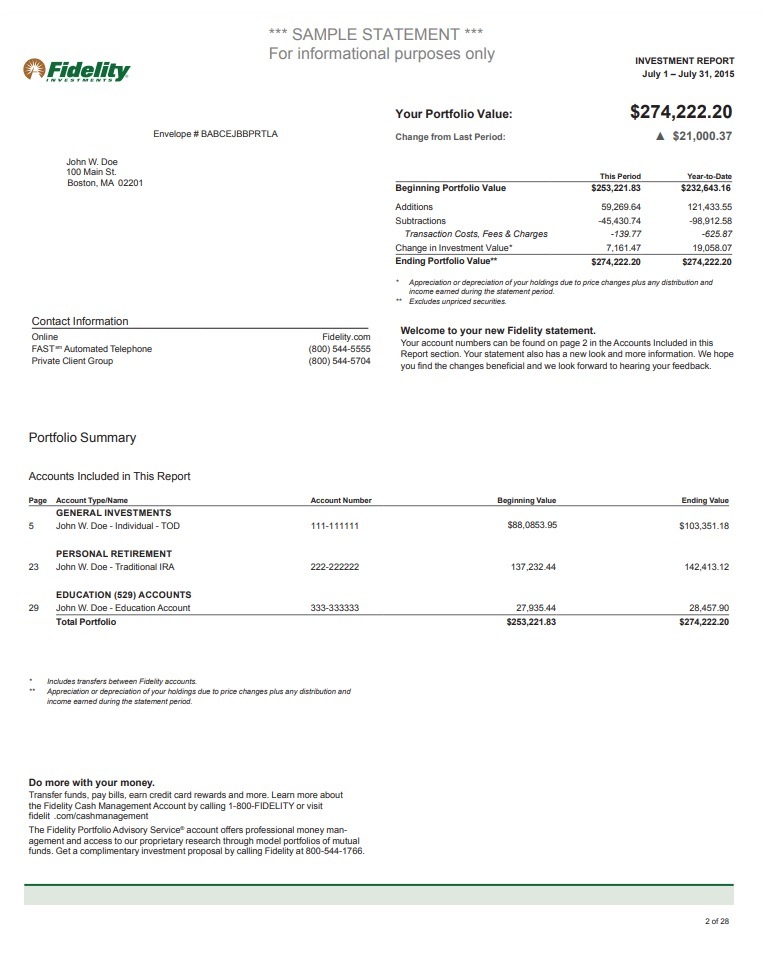

These account statement templates are official documents send by the banks or financial institutions on the midst of their clients as a formal written report of their credit or debit related activities. Over and above, clients itself can ensure whether their accounts are working faultlessly and smoothly. They can also keep their statement of rectification to monitor their own accounts.

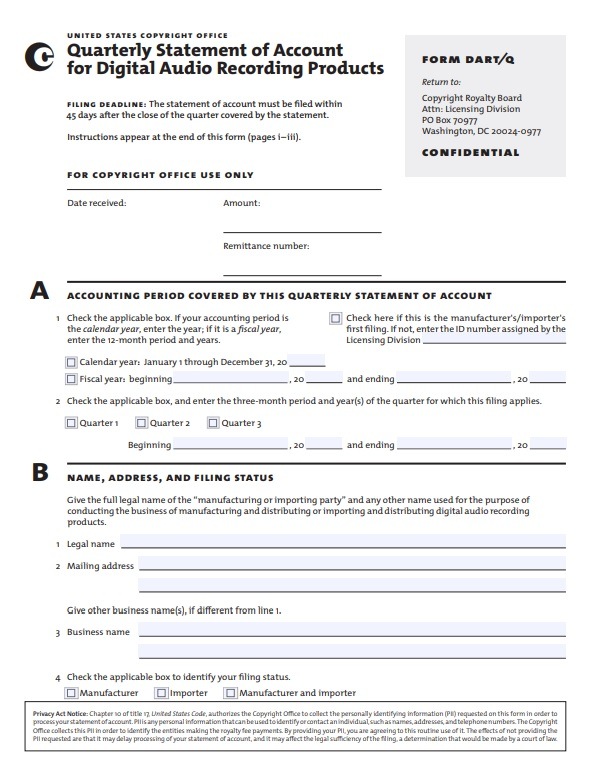

When these statements should Sent?

There is no specific time frame for sending these reports to clients however, these can sent on monthly or quarterly or/and half yearly basis. Banks and FIs invariably issued these statements to their clients as per the regulations and law. However they are also issuing them to keep them update about the activities of their accounts.

What are the Benefits of this Statement?

Apart from this such statement will undertaken the proceedings of bank accounts on the basis of month.Thus this document will use to represent the records of going-on account related proceedings as well as all other activities associated with the credit of bank accounts. In like manner this kind of statements not only gives an opportunity to the clients to keep an eye on their accounts but also helps the bank to compare the statements of clients with registered checkbook. In addition suchlike periodic summary of account activities can also be summarized the mythology of authorized transactions exclusively with the incorporation of dates from beginning to end.

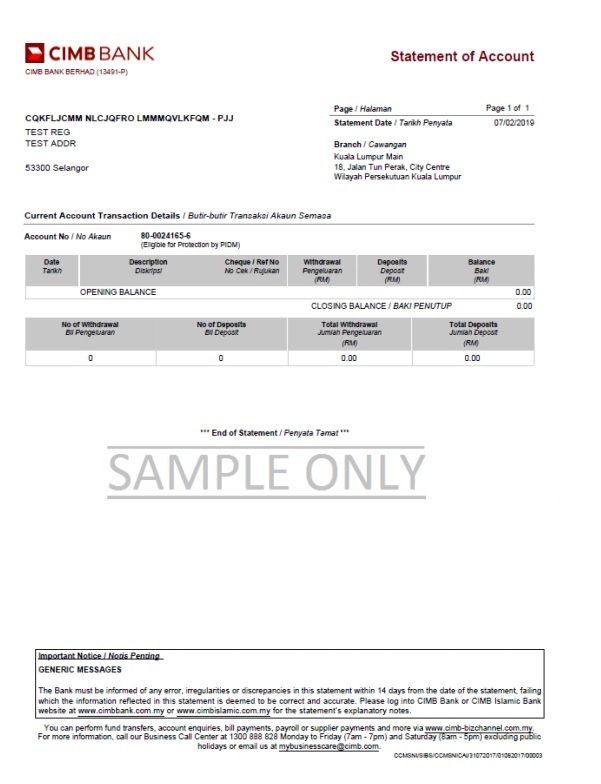

What are the Main Contents of this Statement?

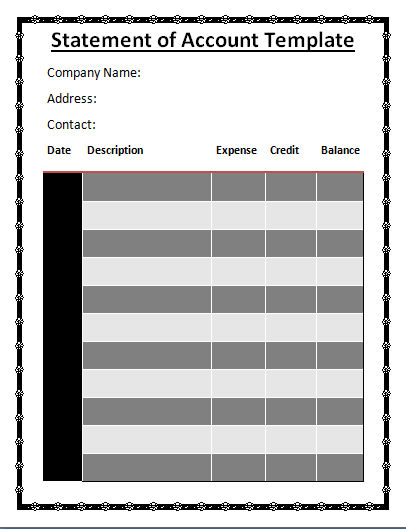

Well there are guidelines for which someone can prepare these kinds of statements. However the basic content which must include in this statement is given below;